CREDITO — building a Credit

Credito brings Financial Inclusion to the “Credit Invisibles” by providing accurate and reliable credit scores.

According to a 2016 report by Nilson, losses from credit card fraud amounted to $21.8 billion in 2015 that’s an increase of 162% from the 2010 figure which was $8 billion. The losses for 2016 are already estimated at over $24 billion, and these losses are expected to reach $31 billion by 2020.

The total value of credit and debit card transactions was $31 trillion in 2015. While the total value of credit card transactions is growing at close to 7 percent a year, credit card fraud is growing at over 16 percent every year.

These losses occur throughout the system, including at the point of sale, at ATMs, and during online transactions. While EMV chip technology has reduced the incidence of in store fraud, it does not help with online fraud.

On the other hand, peer to peer (p2p) platforms are among the fastest growing segment in the financial services space. By Transparency Market Research suggests that “the opportunity in the global peer-to-peer market will be worth $898 billion by the year 2024, from $26 billion in 2015. The market is anticipated to rise at a CAGR of 48% between 2016 and 2024. The market for alternate finance gained popularity in recent years.

According to a 2016 report by Nilson, losses from credit card fraud amounted to $21.8 billion in 2015 that’s an increase of 162% from the 2010 figure which was $8 billion. The losses for 2016 are already estimated at over $24 billion, and these losses are expected to reach $31 billion by 2020.

The total value of credit and debit card transactions was $31 trillion in 2015. While the total value of credit card transactions is growing at close to 7 percent a year, credit card fraud is growing at over 16 percent every year.

These losses occur throughout the system, including at the point of sale, at ATMs, and during online transactions. While EMV chip technology has reduced the incidence of in store fraud, it does not help with online fraud.

On the other hand, peer to peer (p2p) platforms are among the fastest growing segment in the financial services space. By Transparency Market Research suggests that “the opportunity in the global peer-to-peer market will be worth $898 billion by the year 2024, from $26 billion in 2015. The market is anticipated to rise at a CAGR of 48% between 2016 and 2024. The market for alternate finance gained popularity in recent years.

While the growth projections for p2p lending are promising, one of the major challenges is providing a system to reduce fraudulent and high risk activities, as they result in loss of investor confidence and trust.

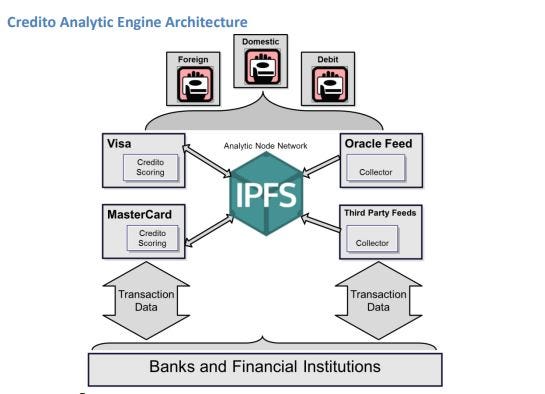

redito adalah jaringan intelijen kredit terdesentralisasi yang memberikan nilai kredit, nilai transaksi dan pasar pinjaman yang didukung oleh blockfain Ethereal, Kontrak Cerdas dan IPFS, yang meningkatkan transparansi dan keandalan.

What is the need of decentralized and transparent Credit Intelligence platform ?

Despite the efforts made by banks, card issuers, and merchants, credit card fraud continues to grow faster than credit card spending. Data breaches have resulted in more card details being compromised, and the growth in online shopping has led to more opportunities for ecommerce fraud. According to a 2016 report by Nilson1 , losses from credit card fraud amounted to $21.8 billion in 2015 that’s an increase of 162% from the 2010 figure which was $8 billion. The losses for 2016 are already estimated at over $24 billion, and these losses are expected to reach $31 billion by 2020.

On the other hand, peer to peer (p2p) platforms are among the fastest growing segment in the financial services space. The market for alternate finance gained popularity in recent years. A finding by Transparency Market Research suggests that “the opportunity in the global peer-to-peer market will be worth $898 billion by the year 2024, from $26 billion in 2015. The market is anticipated to rise at a CAGR of 48% between 2016 and 2024.

A finding by Transparency Market Research suggests that “the opportunity in the global peer-to-peer market will be worth $898 billion by the year 2024, from $26 billion in 2015. The market is anticipated to rise at a CAGR of 48% between 2016 and 2024.2 ” While the p2p platforms continue to face the risk of default, and fraudulent practices, the growth prospects of this segment remain strong, especially in times when the banking sector continues to struggle with lingering damages. Thus, a decentralized and transparent Credit Intelligence platform offers great opportunity for Lenders, Borrowers, and Financial Institutions to reduce their risk.

More about Credito :

Website: https://credito.io/

Whitepaper: https://credito.io/pdf/whitepaper.pdf

Announcement: https://bitcointalk.org/index.php?topic=2483679.0

Facebook: https://www.facebook.com/CreditoNetwork

Twitter: https://twitter.com/CreditoNetwork

LinkedIn: https://www.linkedin.com/company/credito-network

Whitepaper: https://credito.io/pdf/whitepaper.pdf

Announcement: https://bitcointalk.org/index.php?topic=2483679.0

Facebook: https://www.facebook.com/CreditoNetwork

Twitter: https://twitter.com/CreditoNetwork

LinkedIn: https://www.linkedin.com/company/credito-network

Комментарии

Отправить комментарий